- Home

- About

- Advantages of JPods

- Capacity

- Conservation

- Economics

- 10X Capital Savings

- Base the $ on Energy

- Dangerous Economic Assumptions

- Free Markets

- Jobs

- Land Use

- Linear Barriers to Commerce and Nature

- Metrics: Replace GDP with Disposable Energy

- Parking

- Supply_Demand

- Free Market Efficiency

- Net Energy Decline

- Inaccurate IEA Forecasts

- 'Titanic' Oil Economy

- Paychecks and Oil

- History

- Lifeboat Paradox

- Links

- Management Team

- Metrics

- Payback

- Peak Oil

- Project Flow

- Recipe

- Solar

- Technologies

- What are JPods

- Why JPods®

- Be Involved

- Key Steps

- Franchise Agreement (draft)

- Solar Mobility Act

- Own and Operate a JPods Network

- Become a JPods Supplier

- Design Your Own JPods Network

- Investors

- Spread The Word

- 8-80 Cities

- Agreements

- Cities of the Sun

- Domestic War by 2023

- Kitty Hawk Network

- Regulation

- San Jose State

- Scale Model

- Railroad 1862

- News

- Cities

- Contacts

You are here

The Peak Oil concept

The term "Peak Oil" comes from a theory developed by geoscienctist M. King Hubbert in 1956. Hubbert argued that the rate of U.S oil production would eventually reach a pinnacle point of production and then start slowing down. The "Peak Oil" is the point where the greatest rate of extraction of petroleum is reached. After this point, Hubbert predicted the rate of production to stay in a constatnt state of decline.

Hubbert's theory predicted peak oil to occur in 1970. In 1970, his prediction was proved partially true as oil production set an all time record with 9.6 million barrels per day. However, after the peak point occured, oil production didn't continue to decline as predicted due to new driling technology and extraction methods. Hubbert's theory might not have predicted the year of peak oil correctly, but its framework still proves to be true and a potential peak oil year in the future looms over us. In fact, after the EIA updated their International Energy statsisics this year, many geosciencts claim 2015 as a potential peak oil year.

Hubbert's theory also presents us with the flip side of peak oil: peak demand. Changes in peak demand, or the demand for oil, will damange oil-dependent countries to the same extent that peak oil can. Peak Demand is expected to peak wthin the next two decades. Why is that bad? If massive oil importers such as China show a decrease in demand, this inherently will cause peak oil faster and hence bring all the consequences that peak oil will. Taking steps to becoming oil-free right now is the only way we can evade the risk of becoming even more dependent on oil than we are now and facing the consequences of peak oil.

There are many ways of looking at risks of dependending on oil:

- Geological Risks. The risks of oil energy shocks based on the slow pace of oil field depletion is the primary way the US Department of Energy presents information about oil field depletion. The risks are discounted by looking at world oil supply instead of American oil supplies. Here is the data from DOE:

- Link to EIA US Oil Production chart.

- Link to EIA US Oil Production forecast.

- EIA Price Increase graphs.

- Import/Exports compared. DOE assumes a world oil market, rather than an energy self-reliant America in its forecasts.

- Political Risks. DOE ignores political and financial risks from debt. Costs of oil-dollar funded terrorist attacks, nor costs of oil-wars since 1990 are factored into DOE warnings to Americans.

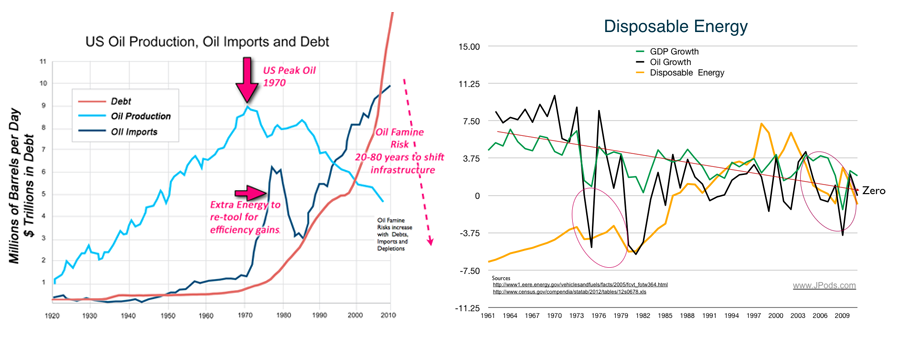

In all of human history there has always been a next war. At JPods we look at the 45% dependence on foreign oil as subordinating the liberty and survival of Americans to a foreign power. The following graph on the left illustrates:

- US Peak Oil in 1970 (left graph, light blue line)

- Correlation between increasing oil imports (dark blue line) and national debt (red line).

- The 4 million barrel per day (mbd), 10-year long spike in US oil imports after the 1973 Oil Embargo caused Americans are suffering Oil Famine, consequences from a monolithic dependence on a source of energy 60% outside our control. Fracking, slow economy, and vehicle efficiency have reduced oil imports.

- Risk of future oil-wars because of foreign oil mandates US actions to protect the foreign supply.

The above graph on the right illustrates that DOE fails to account for oil price and how affordable gasoline will be. Disposable Energy (left graph) is family disposable income's ability to buy energy. Disposable Energy dropped after the 1973 Oil Embargo, 1979 Iranian Revolution and has been crashing since 1998. At no time since US Peak Oil in 1970 has DOE or the oil company's warned their customers that oil prices would rise, taking an every great part of people's incomes.

Life requires energy. Less affordable energy, less life.

Excellent summary of the falicy of exponential growth. This was in 2007:

or in parts

Part 1: https://www.youtube.com/watch?v=F-QA2rkpBSY

Part 2: https://www.youtube.com/watch?v=Pb3JI8F9LQQ

Part 3: https://www.youtube.com/watch?v=CFyOw9IgtjY

I like the graphic presentation at the beginning of Part 4:

Part 4: https://www.youtube.com/watch?v=yQd-VGYX3-E

Part 5: https://www.youtube.com/watch?v=qHuwgxrTKPo

Part 6: https://www.youtube.com/watch?v=-3y7UlHdhAU

Part 7: https://www.youtube.com/watch?v=RyseLQVpJEI

Part 8: https://www.youtube.com/watch?v=VoiiVnQadwE

Theme by Danetsoft and Danang Probo Sayekti inspired by Maksimer