- Home

- About

- Advantages of JPods

- Capacity

- Conservation

- Economics

- 10X Capital Savings

- Base the $ on Energy

- Dangerous Economic Assumptions

- Free Markets

- Jobs

- Land Use

- Linear Barriers to Commerce and Nature

- Metrics: Replace GDP with Disposable Energy

- Parking

- Supply_Demand

- Free Market Efficiency

- Net Energy Decline

- Inaccurate IEA Forecasts

- 'Titanic' Oil Economy

- Paychecks and Oil

- History

- Lifeboat Paradox

- Links

- Management Team

- Metrics

- Payback

- Peak Oil

- Project Flow

- Recipe

- Solar

- Technologies

- What are JPods

- Why JPods®

- Be Involved

- Key Steps

- Franchise Agreement (draft)

- Solar Mobility Act

- Own and Operate a JPods Network

- Become a JPods Supplier

- Design Your Own JPods Network

- Investors

- Spread The Word

- 8-80 Cities

- Agreements

- Cities of the Sun

- Domestic War by 2023

- Kitty Hawk Network

- Regulation

- San Jose State

- Scale Model

- Railroad 1862

- News

- Cities

- Contacts

You are here

2021

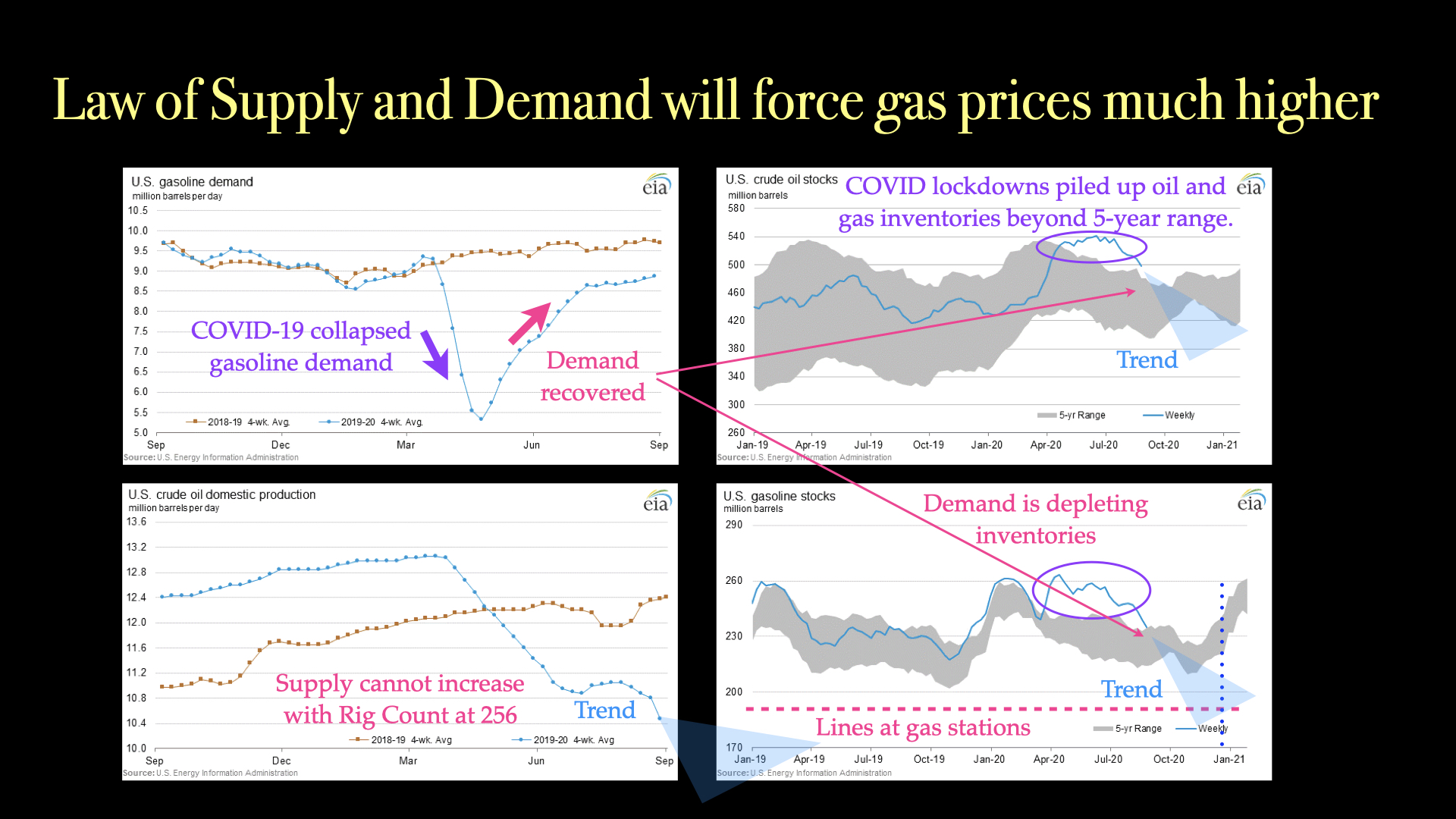

The trend towards gas lines in the US by Jan 2021. Gaslines will occure if US consumption is above 8 mb/d and US gasoline inventories dip below ~190 million barrels. About 190 million barrels of inventory is required to fill the delivery pipelines, trucks, etc....

Rig Count is at 256, Sept 5, 2020. About 1,000 rigs are required to compensate for the 27% per year depletion rate of fracked oil wells:

- Peak Oil, Feb 13, 2020: $207.5 billion in losses.

- Mar. 13, 2020: U.S. Oil Production Could Drop By A Quarter

- Oil Shock of 1973–74

- Dallas Fed: Breakeven Oil Prices Underscore Shale’s Impact on the Market ($49 to $54)

- CNBC: Oil now a ‘bigger problem for markets than the coronavirus,’ analyst says

- Baker Hughes Rig Count

- CNBC: Exxon cuts capital spending by 30%, but CEO says it’s ‘committed to maintaining’ dividend

- May 6, 2020: Implied U.S. Oil Production Shows Material Drop And Looks To Be Headed For 10 Mb/D

- April 28, 2020: 3.77 Mb/D Reduction In U.S. Gasoline Supply, Bullish UGA

- May 19, 2020: UGA: Bullish With New Source Of Demand

- June 1, 2020: Bullish UGA, Undervalued By $8

- June 18, 2020: U.S. Energy Dominance is Over

- June 2020, EIA Permian

- July 2020, Shale boss says U.S. has surpassed peak oil

- Saudi America, Bethany McLean

Background data:

- Dr. Hubbert's 1956 presentation of US Peak Oil by 1970.

- Admiral Rickover's 1957 speech on "energy slaves". Illicit Energy is dependence on energy outside self-reliance. Federal support for foreign oil exactly repeats the path to war of Federal support for slavery.

- Crude: The Incredible Journey Of Oil

- Crash Course by Chris Martinson

- Eight Presidents declaring oil addiction a threat to national security. Proved by oil-dollar funded terrorism and oil-wars.

- Five Presidential veto messages of why Federal oil-powered infrastructure is unconstitutional (Madison, Monroe, Jackson, Polk, and Buchanan).

- Fracking acounts for 65% of US oil production in 2016. Fracking production depletions. Fracking forecasts are unrealistic.

Federal Infrastructure Bill

- $506 billion for roads, bridges and major infrastructure projects, including

- $4 billion for electric vehicles

- $98 billion for public transit

- $56 billion for airports

- $46 billion for passenger and freight rail systems

- $21 billion for safety efforts

- $20 billion for infrastructure financing

Theme by Danetsoft and Danang Probo Sayekti inspired by Maksimer